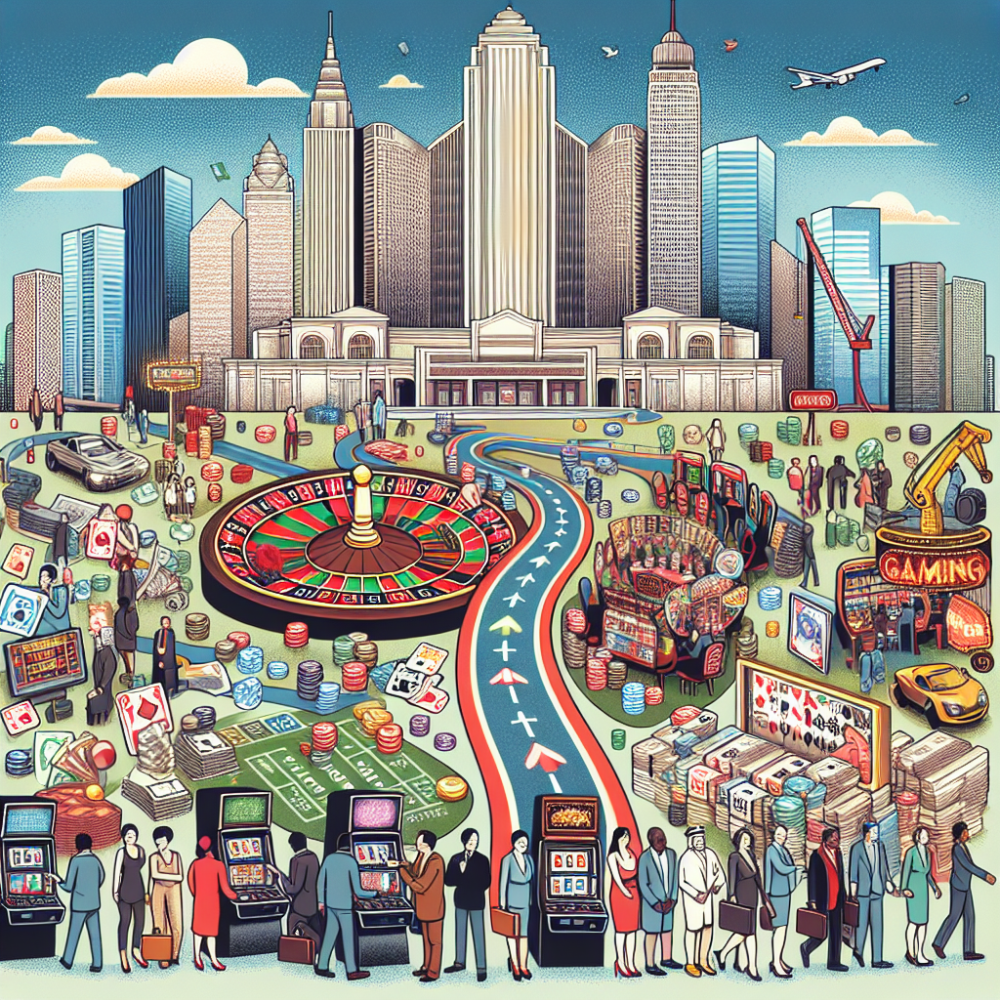

In the contemporary landscape of global finance, the intersection of gambling and financial markets has become increasingly prominent, giving rise to what some economists refer to as the "casino economy." This term, often laden with implications, refers to the influence of gambling-like behavior in financial markets and its broader economic effects. This blog post aims to unpack the complexities of this phenomenon, exploring how gambling principles manifest in financial decision-making and the subsequent ripple effects on the economic system.

The Gambling Paradigm in Financial Markets

Gambling, at its core, involves risking something of value on an event with an uncertain outcome in the hope of winning something else of value. This definition strikingly resembles the activities of day traders, speculators, and even some institutional investors in the financial markets. The similarity lies in the high-risk, high-reward nature of their transactions, often driven by the same adrenaline and dopamine surges that fuel casino goers.

The proliferation of complex financial instruments such as derivatives, options, and futures can be seen as a form of this gambling behavior. These instruments, while designed to hedge against risks, can also be used for speculative purposes, significantly amplifying the stakes involved—much like placing a bet in a high-stakes poker game.

Economic Impacts of the Casino Economy

The casino economy can have profound implications for financial markets and the broader economy. Here are some of the key impacts:

-

Volatility and Instability: Just as a gambler’s fortunes can fluctuate wildly, speculative practices can lead to increased volatility in financial markets. This instability can deter long-term investment and disrupt the allocation of resources to more productive economic activities, potentially stifling economic growth.

-

Resource Misallocation: High levels of speculative investment can divert capital away from fundamental economic sectors such as manufacturing, education, and healthcare. This misallocation of resources can lead to a 'hollowing out' of essential industries that are less immediately lucrative but more stable and beneficial for long-term economic health.

-

Wealth Concentration: The casino economy often benefits a small group of individuals and institutions that have the resources and knowledge to participate effectively in high-stakes financial gambling. This concentration of wealth can exacerbate income inequality and undermine the principles of democratic equality.

-

Systemic Risk: The interconnectedness of global financial markets means that gambling-like speculation can lead to systemic risks. An example of this was the 2007-2008 global financial crisis, precipitated in part by speculative behavior in the housing market and related financial products.

Regulatory Responses and Ethical Considerations

Given these impacts, there is a compelling case for robust regulatory frameworks to mitigate the adverse effects of the casino economy. Regulators could impose stricter limits on speculative trading and require more transparent risk assessments for complex financial products. Additionally, there could be a greater emphasis on ethical investing, encouraging practices that consider long-term economic sustainability and societal well-being.

Conclusion: A Call for Balanced Financial Practices

The allure of quick profits in financial markets can often overshadow the fundamental principles of sound investing. While the excitement of gambling can be thrilling, its principles are precarious foundations on which to build a stable financial system and, by extension, a stable economy. As we move forward, it is crucial for policymakers, investors, and financial professionals to foster a more balanced approach to finance that prioritizes long-term sustainability over short-term gains. This shift is essential not only for the health of our financial markets but for the well-being of our global economy.